Financial Independence Calculator

What is Financial Independence?

If you would like a financial independence calculator, we must first define what financial independence is. We see financial independence in two ways: one being measured as taking care of yourself financially as an adult and another as not needing to work a job. Financial independence is accomplished when a person’s income minus expenses equals a number greater than zero and is sustainable. We will speak on and calculate both definitions if you need more clarification.

Being a Single Adult Financially Independent

Before we go to the financial independence calculator, let us first speak about the first level of financial independence. Typically, you are financial independent when you, as a person, can financially cover your lifestyle. Furthermore, if you are the guardian for children, they are a part of your responsibility. This would mean you do not need to depend on friends, family or significant others to live comfortably, day to day or month to month. In other words, you can handle the responsibilities of an adult and survive without any major financial hardships or issues.

Here is an example of living independently. As an adult, you have bills and essential expenses to live. If you can cover all expenses without asking for financial support on a monthly basis, you can been seen as independent. These expenses include things like food, shelter, electricity and transportation.

Being labeled as an independent person as an adult is usually someone who has a job that can cover the above listed expenses. However, this is where being a financially wealthy, independent person differs.

Being Wealthy as a Financially Independent Person

Now let’s talk about the second level of financial independence. This is very similar to being able to handle the income responsibilities of an independent person. Nothing changes as you should be able to handle all financial obligations without periodically needing help from family, friends or strangers.

The big difference here is, a wealthy financially independent person does not depend on a job to pay for expenses, they use their assets. Assets are things that pay you, daily, monthly or yearly without having to trade time for money. This is the opposite of working a typical nine to five job.

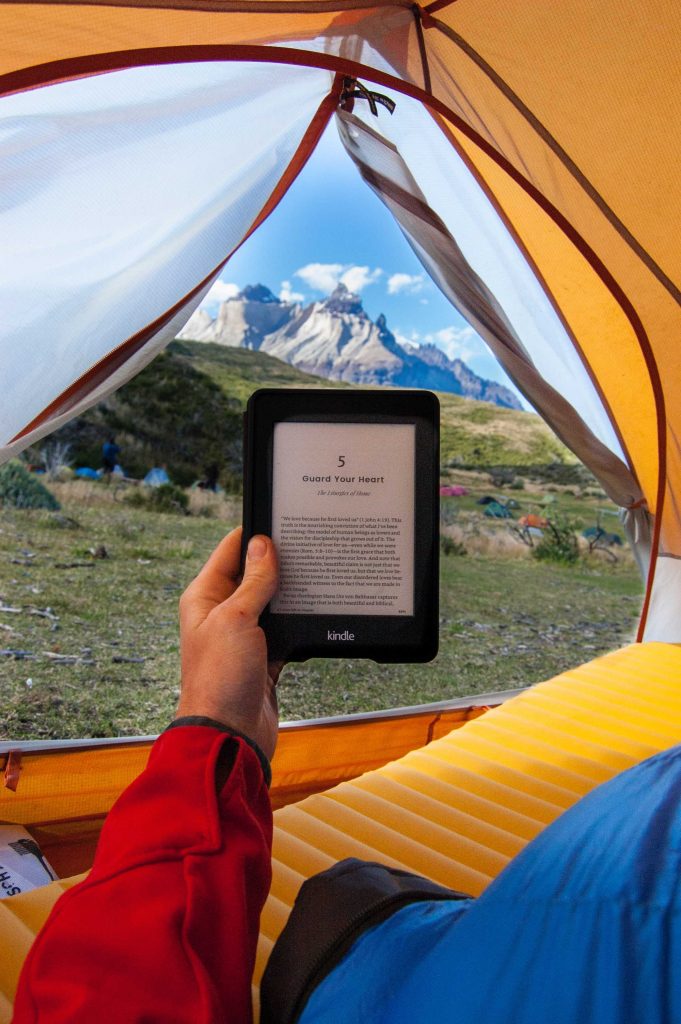

Here is an example of how a wealthy financially independent person would pay their bills. They would use the money from selling an e-book they they wrote on their cell phone to cover the water bill. The e-book was making money last year but still continues to pay the owner regardless if they touch the book ever again. Similarly, the independent person needs to pay their cellphone bill. Instead of saying they need a better job or raise, they used the money from selling their online course; this was also made on the mobile device.

As you can see, a wealthy independent person has replaced working for money with using assets to cover all expenses. The reason you can call this wealthy is because, the independent person has control of the most valuable asset on the planet, TIME.

Time Freedom and Money is Wealth

As a matter of fact, it is not about what you went to school for or how much you make hourly but more so, how little time do you need to invest daily to cover your daily or monthly expenses. If you can work four hours or less per week and live comfortably, you can call this an independent wealthy person. It just depends on who is asking. Now let us do the simple math.

Calculating Single Financial Independence

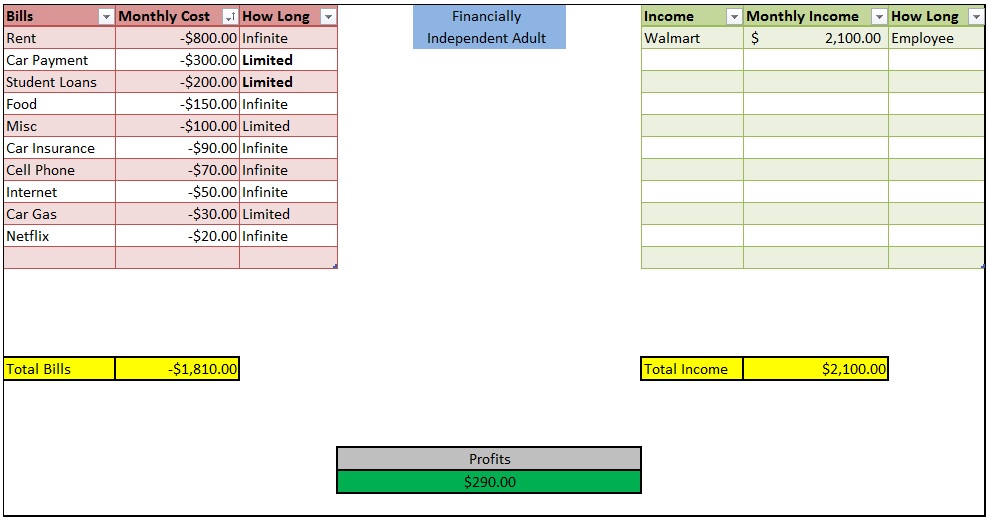

Here is how you calculate financial independence for one adult. Let us assuming we have several bills and one job. We will take our income from a job and subtract the expenses from the income. If the result is a positive cash flow, this can result in being independent. If the result is a negative cash flow, an adult’s financial status may result as not being able to sustain independence.

In the above example, there are several bills listed which result in $-1,8100.00 per month. On the other hand, this person makes $2,100.00 working at Walmart doing 40 hours or more per month. The end result is a positive cash flow of $290.00. You can call this person financially independent because they can pay all of their bills alone. Moreover, after the bills have money set aside, there is still some money left over.

Just to add a little twist, it is easy to see how this person could be seen as financially independent but, unfortunately, not everyone looks at their bills this way. With only $290.00 extra per month, it is easy to go over on your spending limit if not monitored carefully. It would only take a few nights of going out on the weekend or a vacation trip to easily put this person into a negative cash flow. This does not include missing payments and paying interest or late fees.

Calculating Financial Wealth Independence

In the final example, the expenses are nearly the same but the biggest difference is the income. Although both total incomes amount to the same, the income sources are different. Instead of working at Walmart, the wealthy financial independent person does not go into a job. Instead, they have multiple streams of income.

Multiple Streams of Income

Since everyone is not familiar with passive income, let us cover how these other sources of income generate money.

YouTube Income

YouTube can generate income for someone by paying them for ads. When ever an ad shows on someone’s YouTube channel, the channel owner gets income. Equally important, this pays more or less depending on views. If you would like to make money on YouTube, here is one way you can start making money on their platform. This is without even recording yourself.

E-Book Revenue

Secondly, an E-book can generate money because it can be complete, in a week, month or by someone else then the owner can publish the book. A popular place to sell books is on Amazon.com. Digital books or E-books are very popular and are able to create a scalable income for those who purse it as a business. If e-books sound interesting to you, here is one way to startup quickly.

Creating an Online Course

Thirdly, a “How to Course” can be any course. For example, you could create a course that teaches “How to Build a Website”. Moreover, you could promote this course to your YouTube audience and generate sales while you sleep for anyone who is interested in your product. Selling digital products online is a very lucrative business if you have what it takes to make it work. You can learn how to create a digital product here.

Blogging as a Stream of Income

Fourthly, a blog can generate income similar to YouTube, instead of creating videos, you can write article like this one. Not to mention, you can do something like this and much more from your mobile device. Learn more about those opportunities here. To make money, you can add google ads to generate income per add view or when a user completes a particular action. The same goes for selling your own products. I could post a “How to Create a Blog” E-book here and sell it for $10. That would make this blog an asset to create monthly revenue.

Affiliate Marking for Money

Lastly, Affiliate marketing generates money for someone who refers a product. For example, when YouTube users say, use their link in the description to purchase a product or acquire a discount, they are likely affiliated with the product. If a consumer makes a purchase, the referring party will receive a commission. Combine this with the ad revenue and you have two sources of income from one asset. Here is one way to start with affiliate marketing.

Calculation Summary

In closing, most people start out independent as an individual without being wealthy. Truly, no matter which option you aim for or attain, the financial independence calculator is simple math. If you like the concept of being a wealthy, financially independent individual, we send daily wisdom and tips on generating wealth to our subscribers. Click here to learn more.