Don’t Want to Go to College Anymore? What You Should Do

So, you’ve either been in college for a while and decided it’s not your thing or you’ve changed your mind about going. Now what? If you do not want to go to college anymore, you should get a job that pays well enough to cover your bills and have some extra cash leftover every month. After that is done, and if your goal will ever be to leave a job, you should learn to build wealth.

Although everyone’s situation is different, the solution of getting a job is assuming you are not independent and want to be able to live on your own or provide for a family. Although getting a good job helps when you do not want to go to college, you will need to have great plan to handle more financial obligations later.

Why Don’t You Want to Go to College Anymore

Before you are completely assured that you do not want to go to college, let’s look at why. If you want to know how long you should go to college, get the details here.

Don’t Want to go for the Price of College

Do you not want to go to college because it’s too expensive? I had the same issue when I started. I was taking out loans and then, my parents could not get approved anymore so I could not finish college. Not only that, I was stuck with debt and nothing to show for it but a few credits.

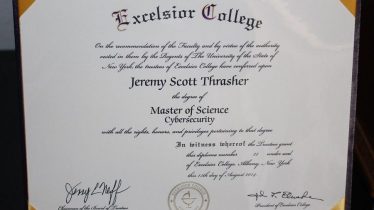

Instead of going back home and getting a job, I ended up joining the military. In the end this worked out for me, but I did not have the information that I know now. Moreover, my goal was to go to college because I thought it would create success so I looked to the military as a way to have a good career and college tuition. Although the military is not for everyone, it is a good solution for most young people who need to become independent.

Before you give up on college for financial reasons, be sure you have considered attending a community college because they are the cheapest and using grants like FAFSA to help with funding. Although you can get scholarships for school, it may be a little discouraging to try but it is still an option.

Lastly, you already knew about loans. If you get a loan, try not to use it to fund student housing or a private school. The better way to use the student loan is to get something like a certificate, not a four year degree.

Don’t Want to Go for the Difficulty of College

If college seems too difficult then maybe you choose the wrong major. Some majors are more difficult than others. If you feel that it is not your major and you have an all around difficulty with college no matter how much you study, then maybe call is not for you. On the other hand, you will need to learn how money works as described later if you do not go to college. Otherwise, you will likely struggle in life or be average.

Don’t Want to Go for the Time Required in College

I can admit, the time required to graduate college can seem discouraging. But, i’d guess for most of us, we do not focus on the years ahead but instead focus on what classes you’re taking and how much you look forward to being in school. If you are someone who is not memorized by the college path then, many years of study and college may seem too much like a daunting task.

If you would like a recommended path to finish college quickly, you will get all the details here on post, how long you should go to college.

Not Wanting to Go to College is Alright

Not many people will tell you it’s alright not to go to college. Unfortunately, most people associate college with success but, it does not relate to success unless that’s what college means to you. Following this further, you can have a great and successful life without college. If you don’t go to college, it can really only make life more difficult if you do not learn how to accomplish your goals for a successful life.

Oddly enough, college was not likely to teach you either. Most people go to college for good jobs that pay well but, unfortunately, jobs do not pay the best money. Jobs typically only pay enough for stability.

You Should Get a Roommate

Since you won’t be going to college and getting a quick job, it is likely that bills can seem expensive. In order to stay one step ahead of this problem before it occurs; assuming it has not already, get a roommate. If you do not live alone, you can split the rent of housing and save some extra money.

This is also great because you can split other bills like internet and utilities. The easiest way to have this going for you is to live with family but, if that is not an option, try to live with your significant other. The sooner you can split housing costs, the easier it will be to gain and keep stability with your job.

You Should Get a Good Job

Although this might seem like common sense, in this post we refer to a good job as one that can cover all you expenses and give you some extra money every month. Without this, you will hardly be getting by and live like what most refer to as “Pay-check to Pay-check”.

Although this can be easier said than done, ensure you are aiming to cut expenses like housing costs and other bills in order to make your job sufficient. Once you have financial stability in your household, you can more easily get to the next phase in your journey of skipping college.

You Should Learn about Building Wealth

Now that you have skipped college and found a stable job, your at the point now where you should invest in wealth building activities. These include and are not limited to, learning how wealth is built and acquiring assets. The reason why it was so important for you to have extra money every most is so that you have the opportunity to invest your money into yourself. Although you can take action towards building wealth for free, some paid options can be much more worth your time.

As a quick overview, wealth is not built by working a job. Wealth is acquired by controlling assets and assets are things that generate an income. For example, if you wrote a book, you could sell it 24 hours a day, seven days a week. A job is just a starting point to get your life stable. Once you have the stability, you can focus on acquiring assets like books, websites or real estate.

Throughout your journey, you will either be investing time or money to get out of your job. For example, you are investing time here to learn about your next step. Next or further down the road, you may want to purchase a book or course to help fast track your success.

At cloudofwisdom.com, we are fans of creating online assets. These can be digital products, e-books or websites. If you would like more information about building wealth, join our email list here. If you are already familiar with the importance of multiple income streams then you may want to see our recommended tools page for more ideas on starting an online business.